Estonia is quickly becoming known as e-Estonia, due to its focus on a digital future as an e-society. It’s a success story that came from a forward-thinking government, pro-active ICT sector and a switched on, tech-savvy population.

The hospitality of Estonia

“Full of surprises” is a three word summary of my May 2016 visit to Estonia as part of the Free Market Road Show speaking tour of 2016). I had been well-briefed, but to experience Estonia was like visiting a fine restaurant that exceeds even the rave reviews that brought you there. The ease with which appointments were made and the overall congeniality exceeds any other country I’ve ever visited.

Fresh on arrival from London I enjoyed a welcoming dinner with Meelis Kitsing and Petri Kanjander for a briefing and an outline of the Free Market Road Show to be held in the Estonian capital Tallinn a couple of days later. The next morning started with a breakfast meeting with Siim Sikkut, digital policy advisor for the Estonian government. We spoke quickly as I had an 11am appointment with former Estonian Prime Minister Mart Laar, whom I had met and enjoyed time with at the 2005 Mont Pelerin Society meeting in Iceland.

Fresh on arrival from London I enjoyed a welcoming dinner with Meelis Kitsing and Petri Kanjander for a briefing and an outline of the Free Market Road Show to be held in the Estonian capital Tallinn a couple of days later. The next morning started with a breakfast meeting with Siim Sikkut, digital policy advisor for the Estonian government. We spoke quickly as I had an 11am appointment with former Estonian Prime Minister Mart Laar, whom I had met and enjoyed time with at the 2005 Mont Pelerin Society meeting in Iceland.

Let me digress for a moment to illustrate the hospitality of the locals.

I knew that Mart Laar’s office (as current chairman of the Bank of Estonia) was within easy walking distance of my hotel so I set out with directions from the front office (turn right, cut through the park, and you’re there). However, after some walking I realised I was running the risk of being late for my appointment so I enlisted the aid of a youthful Nikolai Laht. He saw that I was walking in not quite the right direction and offered to walk with me to the Bank of Estonia. I left him with my business card and the comment that I may be able to help him if ever got lost in Australia. His further attentiveness was obvious when I returned to the hotel room to find that he had emailed me a greeting together with a Google map marked up with the directions for my next visit.

Before giving you some information on Estonia let me include some of my speaking notes.

2016 Free Market Road Show

“Australia’s claim to fame in Europe is not just that we came second (to Ukraine) in the recent Eurovision Song Contest. No, Australia’s other claim to fame, is the small but significant part it played in the introduction of the Flat Rate Tax to Estonia in 1994. I’ve written about this in a book that I published in 2009. I won’t detail the story here, however, except to note that it explains how Sir Arvi Parbo, whom I have known since I was seventeen, was involved…(for more on this, download Heroic Misadventures for free).

Sir Arvi, an Estonian by birth, is probably the most respected company director that Australia has ever produced. So that’s one up for Estonia! I had the opportunity of speaking with Estonia’s former Prime Minister yesterday, reminiscing about those events that led to that reform and we chuckled about it. I must say that Mart Laar is a role model to the rest of the world. He is a rare politician who understands the value and the benefits that flow from good policy.

He introduced two waves of reform, each with a different focus, each time successful. The first wave was to remove corruption from Estonia. The second was to reduce the size of government, to ‘live within their means’ without ‘stimulus’ or debt. His clarity of thought impressed me (something not often seen in politicians) as he explained Estonia’s determination to solve budgetary problems without borrowing or increasing taxation. His reforms and his choice of very good people to travel with him has left a lasting legacy. He is, rightfully, acknowledged as one of the new Estonian founding fathers.

The first rule of business is to select and only surround yourself with very good people. There have been some significant reforms in your part of the world that can teach us much, with outcomes that remind me of a Ronald Reagan quotation:

“There have been revolutions before and since ours, but those revolutions simply exchanged one set of rulers for another. “Ours was a revolution that changed the very concept of government.”

Reforms often change the concept of government by limiting government to the very few tasks that we can’t do best for ourselves as individuals. Then the secret is making those policy changes stick and I’m gathering information on who has been successful there.

Australia, too, benefited from some economic reforms in the decade-or-so from 1986 to 1998. However, that push for reform has stalled and there is now insufficient political courage to continue the process—for example, by simplifying our incredibly complex tax structure. The idea of a simple Flat Rate Tax is not even discussed. The vested interests (hordes of advisers) just love the complexity of Australia’s Tax Act because they can use it to their own benefit. (I have too, on several occasions.)

Capitalism breathes through tax loopholes

I’d like to talk about the complexity of the overall tax regime in Australia. Economist Ludwig von Mises once said that capitalism breathes through tax loopholes and author Trey Thoelcke expands on Mises’ insight as follows:

“Loopholes get a bad rap because they are perceived as ‘unfair’. But loopholes are the natural outcome of a political system controlled by the compromise of hundreds of politicians in a single room that have to agree and pass something. It is never a clean, loophole-free bill.

“Perhaps what is more unfair is the fact that a group of people who contribute nothing to a business can take away that business’s income at will just by agreeing to it through some loophole-ridden compromise.”

Complex taxation arrangements were well described around 500 BC (2000 years before Adam Smith called for a ‘simple system of natural liberty’) by one of the first libertarians Lao Tzu when he wrote:

“The more restrictions and limitations there are, the more impoverished men will be. The more rules that are imposed, the more bandits and crooks will be produced.”

The burden of taxation

Let me show you how complex Australian taxation is. It is so complex that I don’t know any Australian who can tell you exactly how much tax they pay. Several years ago I bought a new car and it took me a full day to work out how much tax I paid on the car. When I discovered how much tax I had just paid, I wondered if I should ever buy another car.

It’s easier to explain to children the burden of taxation in Australia. I explain it to them by asking two questions. Firstly, if a stranger politely asked if he could taste your ice-cream what would you do? The children inevitably say, “I suppose I’d let them.” Secondly, if a stranger comes along and takes half your ice-cream what would you do? They think about it for a while before replying, “Oh, I’d hide it so they could never, never do that again.” I then congratulate them for understanding how taxation works. They get it immediately.

It’s easier to explain to children the burden of taxation in Australia. I explain it to them by asking two questions. Firstly, if a stranger politely asked if he could taste your ice-cream what would you do? The children inevitably say, “I suppose I’d let them.” Secondly, if a stranger comes along and takes half your ice-cream what would you do? They think about it for a while before replying, “Oh, I’d hide it so they could never, never do that again.” I then congratulate them for understanding how taxation works. They get it immediately.

Following the successful introduction of Flat Rate Tax to Estonia (in 1994), by 2000 there were 24 countries with Flat Rate Tax and only eight of them were non-European countries—which illustrates what a significant revolution it was. Several have since moved away from Flat Rate Tax and that worries me. What could be the reasons? I’m wondering whether it traces back to the Public Choice Theory where the vested interests feel that there is money to be made, by making it complicated again, so to receive the ‘concentrated benefits’ with the costs shared over the general population.

I’d welcome the introduction of a Flat Rate Tax in Australia because I’ve seen how well it works in Hong Kong. They have had a Flat Rate Tax since 1940. The title of one session today is Death and Taxes. I can think of one reason why that title may have been chosen. I’m cynical of governments when they get too big. Governments then only excel at two things.

One is stealing money from their own people through taxation. The other thing is killing both their own people and other people (history is my evidence). They are the two things that governments excel in, stealing and killing, so it is a reasonable title for today’s session.”

A meeting with Mart Laar

So, back to my meeting with Mart Laar. His comment to me ranks him as a true statesman when he said:

“The Asian Financial Crisis had a very serious effect on Estonia and we realised that we had some serious decisions to make. We knew that to borrow or print money, or ‘stimulate’ as other countries were doing, would do tremendous long-term damage to our country. On the other hand we knew that shrinking the size of our government would be unpopular, so unpopular that we could be voted out at the next election.

“However, we knew exactly what the alternative was so we took a deep breath and did the right thing, by shrinking the size of government…and this is how we did it.”

And then he (with later input from my well-informed hosts in Estonia), explained the remarkable process that they adopted to successfully ” shrink government”. The decision was to embrace the digital e-commerce model in government from top to bottom.

Having had remarkable success with their first phase of eradicating corruption, it was then to be used for streamlining government. They knew this had to be a complete rebuild of their systems and the shrinking process was largely through voluntary resignations of the older public servants “who felt they were beyond being retrained” so they took this as an opportunity to simply retire. Unlike Australia, Estonia was not confronted with crippling “redundancy packages” and it was all done fairly peacefully and apparently with few recriminations.

Partial digitisation of a system never works because it is continually reconnecting with all the earlier paper systems on the periphery. One model of “how not to do it” is being taught at the Estonian Business School and highlights the example used by the Australian Armed Forces where they partially introduced an e-payments system. This failed because it was interconnected everywhere with the old paper system.

As a result it was abandoned at total write-off cost of $15m USD. That seemed to be the only Australian example that is taught at the Estonian Business School.

e-residency and e-security

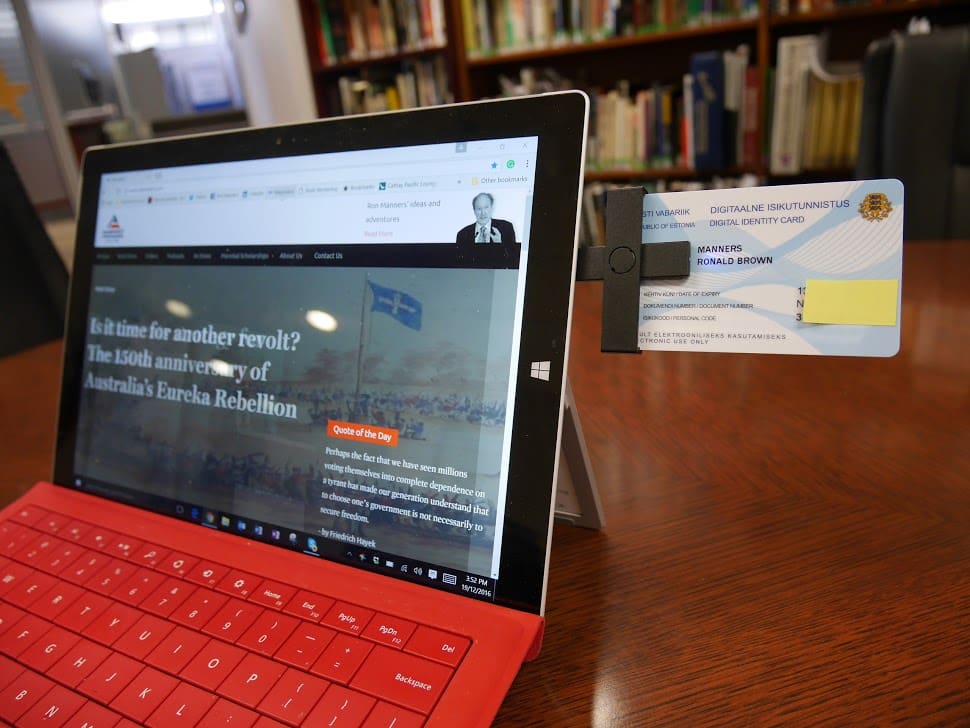

Now, before giving you some particulars of Estonian e-residency (yes, I am now an e-resident of Estonia), more details of their e-government and e-voting (which avoids issues such as this) and how they took their lead in e-security, let me hand over to economist Dr Richard Rahn.

With e-residence in Estonia it is possible to create a company there within seconds, all online, possible to obtain building approvals with equal simplicity, enjoy Flat Tax Rate and the many other benefits that accrue to e-residents of Estonia. There is a series of useful videos, explaining how it all works, which can be found here.

Cyber security

In 2005 the Estonian government decided to shift some former Soviet Union statues from the city centre to the outskirts. This brought on the wrath of the Russian government who, using cyber attacks, brought the whole of Estonia’s banking system to a holt and caused widespread panic.

In short, having suffered such a cyber-shock the Estonians quickly turned their disadvantage into an advantage by approaching NATO and using the attack as an example warning NATO of what could happen to them and other friendly countries.

NATO was very happy to receive this Estonian briefing as they had been contemplating such an event and had been planning where to establish their international base for cyber security. Estonia’s approach was timely and it now hosts the world’s premier cyber-security conference. The world is now flocking to learn new defences against cyber attacks.

1 Comment

Excellent article that allows disclose the potential to increase efficiency and reduce corruption in our countries.

Thanks a lot from Perú.