This is an excerpt from my book, Heroic Misadventures. Read the full story here by downloading the free ebook.

My brief career in banking

In the late 1970s I began working for a rapidly expanding merchant bank by the name of Nugan Hand. This was an exciting adventure. Australia was in such a political mess in the 1970s and Prime Minister Gough Whitlam’s policies were driving businessmen out of Australia. It was common to see a sign on office walls saying: “Will the last businessman leaving Australia please turn off the lights.” As these business people were leaving, they needed to take some of their own money with them, so these draconian government policies gave birth to a flourishing money-laundering business. This worked well for Nugan Hand until its boss, Frank Nugan, was murdered on Australia Day 1980 and his business partner went missing not long after.

As a brief background, let me give you a mental picture of the particular era in which this story is set. It started on January 8, 1977 and continued through to Australia Day, January 26, 1980. It was only three years, but now, almost four decades later, I am still trying to work out just what happened. All events should be judged against the political fabric of the time. Australia was just recovering from the Whitlam era and the business community was battered and bruised. Prospects were bleak and many people were leaving the country. Anyone with any significant income was involved in so-called “bottom of the harbour” tax schemes, which were quite legal at the time.

John Howard, as Federal Treasurer, brought in his retrospective legislation in an attempt to turn law-abiding citizens into criminals, by back-dating legislation. At the time I was President of the Kalgoorlie Chamber of Commerce, so I had a pretty good idea of the level of local difficulties. Kalgoorlie was geared up for a continuing nickel boom but that was well and truly coming to an end. I was personally fatigued from continuous attacks from the Australian Taxation Department (ATO), who were misunderstanding the Taxation Act with respect to my prospecting activities.

Opportunity knocks

There was no point in earning any income in Australia as it would simply be seized, so I became an “odd job man” running a hotel in Bali and looking for nickel in Indonesia. It was in this context that opportunity knocked on my door in the form of an advertisement in the January 8, 1977 edition of The Bulletin. It asked: ‘Do you want to work and live overseas? Are you a pioneering type? Is your vision of your ability to succeed larger than what is presently being received in Australia? I certainly met the criteria.

The advertiser was listed as a small but rapidly expanding banking group. This was also in the days when banking was a well-regarded occupation. Despite Australia having produced several political and business scandals, the banking industry was still seen to be relatively clean. I sent my job application to Hong Kong, complete with a rapidly assembled CV (which looked pretty good for a person without a proper job). Back came the reply from the Swiss Pacific Bank Trust in Hong Kong, expressing interest in my application and offering me an interview.

A fancy brochure and an international currency chart was all the background information I received. The chart was interesting in that it showed various currencies charted historically against the Australian dollar. Particularly interesting was that anyone switching from Australian dollars to Swiss francs in January 1971 would have been 45 per cent ahead by December 1976. Before attending a job interview, I always did my own research. This is what I found:

“There are a series of objections to the use of the name Swiss Pacific Bank and Trust in Hong Kong for two main reasons. The Swiss Government has objected as they feel strongly about the use of the words Swiss or Switzerland in connection with banking, particularly when there is no Swiss connection. The Hong Kong authorities do not allow the use of the words Bank or Trust unless it complies with very strict guide lines and a well-established track record. However in view of the people behind the organisation, it should still be taken seriously.”

That was good enough for me. By the time the interview rolled around, the company had changed its name to Nugan Hand Bank. It was later changed to Nugan Hand International.

Meeting the bosses

Frank Nugan and Michael Hand, the two main principals of the bank, were larger-than-life characters and immediately made me feel at home and confident in their abilities and in the team of people they had gathered around them. Frank was 35, powerfully built and well dressed. A legal and financial expert with a voice as smooth as a well-oiled safe door, he grew up in the small town of Griffith in NSW, where his parents ran a fruit and vegetable packing business. He graduated with a Bachelor’s Degree in Law, then took a Masters at Berkeley in California and a Doctorate in Canada, where the government put his talents to work framing new corporate and financial laws.

Mike Hand was 36 and had a physical bulk surpassing Frank Nugan’s. Mike began life in New York, spending four years at university studying forestry and its financial underpinnings before going to work as a school teacher in Los Angeles. He mentioned that his education was interrupted in 1964 when “Uncle Sam decided I would look better in green.” He skipped officer’s school and went to Vietnam two years later as a private in the US Special Forces. There he became a war hero and the holder of America’s second highest gallantry award, a Distinguished Service Cross. Records show that in 1966 he was one of only six survivors of a 200-strong unit which held out against 2,000 Communist troops at the Dong Xoai crossroads, 35 miles north-west of Saigon. This was the first big battle of the Vietnam War. He had carried his wounded commanding officer on his shoulders until they were out of range of the enemy.

After his discharge from the army he moved to Australia. There he met Frank Nugan and they started out as freelance investment advisors during the period when international companies were clamouring for a stake in the Australian mineral boom of the late 1960s. In 1973, the Nugan Hand group was formalised as a public company with paid-up capital of A$1 million and then expanded in 1976 as a Cayman Island company with a paid up capital of US$1 million. This, they explained to me, had blossomed into a ‘full service’ private bank giving, on the one hand, a flexible and secure depository service for long and short-term funds and, on the other hand, access to professional services divisions. This was all built around a 70-strong task force of lawyers, accountants, management and business consultants, many of whom were cross-trained because of what Frank Nugan called ‘a wonderful interchange of technical skills within the group’.

Cleaning the cash (in plastic buckets)

Their story was quite believable and it was pioneering banking work at that time. Nugan Hand was the first bank to introduce money market operations to Hong Kong and they were beating Westpac by bringing money market operations into Australia. I can’t help but smile as I look back on some earlier notes from my meetings when it was explained to me what ‘full service’ really meant, specifically in relation to ‘walking a client’s dog’ or ‘washing a client’s car’. It is also important to remember these were the days before drug dealers and terrorists gave money-laundering such a bad name.

During my time with Nugan Hand I did not aspire to any particular title but showed particular interest in being a ‘bagman’ and ‘special projects officer’. This did not involve getting on a plane with a suitcase full of bank notes, but it did involve getting Australian money out of the country.

Money laundering at the time needed just two complementary individuals — one in Australia and one overseas. At the time there was no shortage of Indonesian Generals with money they could not explain. They were so keen to get their money to Australia, particularly to purchase a block or two of Sydney harbour-side apartments. All it took was for the Australian dollar bank notes to be counted in Sydney and placed in plastic buckets. Similarly, the Indonesian Rupiah were counted in Jakarta, to ensure equivalent value at that day’s ruling exchange rates.

Settlement consisted of a single phone call and the money, complete with plastic buckets, didn’t move, but simply changed ownership. That sort of settlement works best when people are blessed with easily recognisable voices and I am told this was one of my strengths. Conveniently, during these years, Jakarta provided banking with no currency controls to anyone other than an Indonesian national, so it was easy to direct money from Jakarta to anywhere in the world, but virtually impossible to do this from Sydney. Plastic buckets were used as they were seen to be disposable and untraceable and each party actually brought their own empty briefcases to the settlement.

A fee of 8.5 per cent was charged to each party and, as in all good transactions, everyone went home happy. In respect to special projects, one into which I put a lot of work was the Minerals Exploration Project, where I formed a three-way joint venture with Frank and Mike by establishing a new company called Mining Resources (WA) Pty Ltd. It involved nine Kalgoorlie-based nickel and platinum prospects which were all ready for exploration and set to commence with a $500,000 annual budget. This was a significant figure in 1978 and times were tight. A lot of consultants and geologists were looking forward to this exploration program.

How the other half lived…

Apart from the nuts and bolts, there were some highlights on the social events side and I recall one interesting day at Frank Nugan’s home in 1978. Frank had a luxurious home in Vaucluse Bay, right down to the water, with its own pier and private beach. He suggested I spend a Saturday with him and a group of his friends he thought I should meet. About the only person I knew was PLS, a well-known Sydney company promoter. The others I knew by sight or reputation and they included senior figures from the NSW State Labor Party, plus a few very high-profile Federal Australian Labor Party (ALP) figures. Some of the senior ALP figures made very appreciative comments to me about how Frank Nugan had arranged their taxation affairs in such a way they need not make further payments to the ATO.

I recalled these interesting comments later when the ALP campaigned and brought intense pressure to bear on the Liberals for having permitted widespread use of these ‘bottom of the harbour’ schemes. It was risky of them to throw stones when so many of them lived in large ‘glass houses’, especially when the Deputy Leader of the ALP later turned up the heat on these ‘bottom-of-the-harbour’ schemes as a way of embarrassing the Fraser Liberal Government. If any group of people had something to fear from the information that Frank Nugan carried in his head, it was this group of senior ALP figures.

…and died

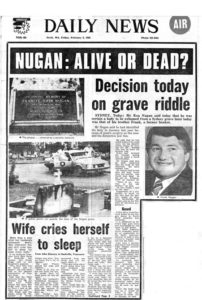

But it all came to a sudden end on the Australia Day weekend of 1980 when I received a phone call to say that Frank Nugan had been found dead, with his brains splattered all over the inside of his Mercedes, on a deserted country road near Lithgow, NSW. While his death gave every appearance of being a suicide, I had several doubts, as did others. I knew Frank well enough to rule out suicide. There were no fingerprints on the rifle, or at least, no check was made.

The death inquiry was handled by a country coroner whose comments indicated that from the way Frank was shot and the position of his body that “he would have had to been a contortionist for it to have been suicide”. There were several strange aspects in respect to an insurance policy for $5 million on Frank’s life. If you take out such a policy, it has to run 13 months pre-suicide for it to be effective. Frank’s secretary, Patricia Swan, had failed to meet one of the instalments and the policy was reinstated in September 1979.

Frank was shot only a few months later, hence there was a lot swinging on the outcome of the suicide versus murder decision. On the day of Frank’s death, there was a $US100 million transfer due to take place, arranged through the person who set-up Philippines’ President Marcos politically and financially. No-one is quite sure what happened to this transfer.

Frank’s death certainly wasn’t good for business. I followed the ensuing events with a great interest, but from a safe distance. Of course all hell broke loose, with shredders operating in the Nugan Hand offices 24 hours per day. Claims of gun-running activities and links to drug dealers and the CIA were daily features of the media for several years. But despite the media claims, I doubt if Nugan Hand was involved directly in the drug trade.

Following Frank’s death, the continuing operation was run by Mike Hand, who imposed a reign of terror over his staff. There was constant media harassment and he was paranoid that some of their secrets would be revealed. Then, on June 6, 1980, Mike Hand himself mysteriously disappeared. A half-eaten meal was still on his table and all of his clothes were still in place, and there were rumours that a professional killer had arrived in the country with a contract on his life.

Meanwhile, throughout 1980, there were constant reports of Frank Nugan sightings around the world and, just before Christmas, the NSW Corporate Affairs Commissioner approached Inspector Harry Tupman of the Homicide Squad with a request to exhume Frank’s body for further identification. His original burial, apparently, was a complete shambles. At first, police said he had been cremated but later changed their story.

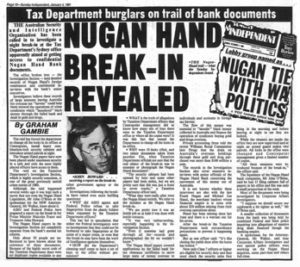

The publicity around this time was intense as there had just been a break-in at the ATO’s Sydney office, apparently aimed at gaining access to confidential Nugan Hand Bank documents. One would assume that there were some secrets that were causing discomfort in high circles. After the Nugan Hand bank collapse, AMRO Bank came out fromHolland specifically with the intention of taking the Nugan Hand Bank over from the receiver. It intended to take over all the operating divisions and pay out all creditors. Prime Minister Malcolm Fraser refused to permit the transfer of the banking licence. The offer letter from AMRO Bank stipulated the licence as a condition, so they could not proceed with the deal. This misdirected “nationalism” from our politicians damaged a lot of people.

One task remained, however, and that was to resolve the board of director’s structure of Mining Resources (WA) Pty Ltd. A difficult task given that one of my co-directors had been murdered and the other was missing. So I held a board meeting on my own, and visualised receiving resignations from the other two. I also took that as an opportunity to resign myself. The new directors, Peter Munachen and Geoffrey Stokes, were duly appointed in our place and the company went merrily on its way.

Back to mining

A lot has happened since that Nugan Hand adventure closed in 1980. My brief banking career gave me an opportunity to experience an environment where things were not quite as they were originally represented and it was with some relief that I returned to the more open and rewarding world of the Australian mining industry.

There are just as many surprises in mining as there were at Nugan Hand, but the outcomes are usually beneficial to all parties. This is one of the fantastic things about our mining industry — there doesn’t need to be a victim for you to succeed. Unlike war, where the strong overcome the weak, in our business as in most ethical businesses, the strong impart strength to the weak. You see this proliferating throughout so many industries. Thousands of joint-ventures, where each party contributes their own unique strengths, ensure that the combined entity gains momentum.

Incidentally, the sightings of Frank Nugan ceased following his reburial, but Mike Hand sightings have been a regular event ever since and, ten years later, Brian Toohey (The West Australian, April 1, 1991) traced his movements without much trouble and wonders why the authorities did not do likewise. On March 1, 1985 I received a phone call from Les Peet and Brian Molloy, of the Stewart Royal Commission, stating that they wished to visit me in Kalgoorlie to ask some questions about Nugan Hand.

Incidentally, the sightings of Frank Nugan ceased following his reburial, but Mike Hand sightings have been a regular event ever since and, ten years later, Brian Toohey (The West Australian, April 1, 1991) traced his movements without much trouble and wonders why the authorities did not do likewise. On March 1, 1985 I received a phone call from Les Peet and Brian Molloy, of the Stewart Royal Commission, stating that they wished to visit me in Kalgoorlie to ask some questions about Nugan Hand.

I simply said to these gentlemen, “I only did a bit of prospecting work for them and nothing really ever came of it.” Fortunately I didn’t ever hear from them again.

1 Comment

An interesting life you have led Ron. Congratulations on this piece. I enjoyed this article. You have captured the 70s Political History very well. Cheers Robert