Transcript:

Thanks Bob. I was just wondering about the few people that have come by, probably going to the Pan Continental Meeting next door, they’ve opened the door, they’ve seen we’re having a meeting in here with all the money [this refers to replica notes printed by Taxpayers United emphasising how government has decreased the purchasing power over time of the monetary unit]. I wonder what they’re really thinking.

As Bob and Greg did, I’d gathered some files on the cost of government and costs of tax. And I guess we just really don’t need these. But there’s one thing that’s relevant. There’s a quote here once again from Hugh Morgan, where he points out the cost of each politician, the cost to the taxpayers, is $250,000 per year to feed these politicians.

Now that’s okay, it’s just a statistic, but I mention here and I mention Graeme Campbell. If Graeme Campbell can turn the federal government around on their proposed gold tax, then I think maybe that $250,000 is the best investment this area has ever made, so I certainly wish him well. Graeme has actually offered to give me lots of examples of government waste that really rile him. And from quite a few discussions I’ve had with Graeme, I’d say he’s probably the best Federal Member the Goldfields has ever had. And I certainly wish him well, because he’s putting our case very well and very strongly to Canberra.

There’s another file, “Reasons why the Tax Summit won’t help,” “Why the consumer tax will be a disaster.” Another one called, “What Can We Do?”

I think it’s obvious that nobody’s going to save us but ourselves in this terrible situation we’ve got.

And I’ve got, I think, three or four points to make.

One is that, number one, we should educate ourselves. And I don’t mean books produced by Government Departments, and most of the books on how to run a business seem to be printed by the Government these days or the Small Business Development Corporation or some of these other Government Departments. Well, we should learn how to protect ourselves from these books, via books produced by people on our side of the fence, not on the enemy’s side.

If you want some advice on what to read, there’s bundles of books … This is a monthly magazine being produced called Optimism. It’s full of the good news, and there’s a lot of it around that doesn’t make its way to the newspapers. There’s a lot of good stuff in that one. There’s some free copies here for anyone to grab and take away tonight.

I think we should educate ourselves to the point that we can explain to politicians and our political representatives, whenever we meet them, whenever we talk to them. Explain to them that we insist they bring about a reversal of the current mess. Remind them that the Keynesian-Marxist economic theories that many of them have been following have been thoroughly discredited, in so many countries leaving the people there impoverished and in many cases actually starving. These are the same economic theories that they’re dabbling with in these White Papers. It’s incredible.

We should show them how history has always demonstrated that regardless of short term benefits, in the long-term government intervention into private peaceful activity in the economy of the country tends to make things worse, rather than better, every time. And there’s a book I’ve got about 4000 years of examples, where they’ve collected these instances.

Let them know at all times that we are aware that the only lasting way to increase the standard of living of people, is to increase the amount of capital invested per capita. And that the proper political and economic strategy would be a program of drastic tax reductions. Firstly. We must have tax reductions with investment tax credit to increase the investment with the total absence of Capital Gains Taxes and this would shortly be followed, I say, followed, by a drastic reduction in government expenditure.

When they tell you about all the unemployment that will be created by a reduction in government expenditure, we should be educated enough to tell them that the stimulus provided to the private sector by these actions will in turn compensate more than necessary for any momentary increase in the government deficit, even if they took the predictable step on being a few months late with some of the reductions.

And I found that they’re still running on with this high expenditure gap, the momentum would be such, and the tax base would be broadened by all of us earning more, all of us paying more, that we’d pick up that shortfall in the deficit without any trouble at all. These are things they can’t argue with.

Other countries are doing this. Other countries are steering toward this privatisation. There’s some classic examples in here of Margaret Thatcher’s government and this Dr Madsen Pirie that people associated with me brought to Australia and carted him around to every state. How they’re dismembering things like the State Housing Commission, how they’re dismembering in England Telecom, and selling off the shares to the public, selling off British steel. These things are very successful, they are doing them in such a way that there’s no dislocation of people and it’s really a professional approach. I draw attention to that one there.

The point I think not generally realised by either Liberal or Labor Parties, unfortunately, is the importance of increasing the reward for working, investing and producing. Cutting taxes that don’t increase the reward or change economic behaviour is really no tax cut that is going to have any effect on the productive sector of the economy. It was said that the politicians and bureaucrats are probably short on realism, probably because they’re busy, probably because they’re reading all the papers and all that stuff.

There’s a reason for them being busy. They don’t appear to grasp the fact that if you reduce the after-tax reward for something, you get less of it, and if you increase the subsidy of something, you get more of it. But I think that’s today in Australia, we are taxing work, we’re taking savings, investment, thrift, productivity, effort, success and risk, and we’re subsidising all these other things like non-work, unemployment, debt, borrowing, consumption, leisure, idleness, and mediocrity, and we’re getting so much more of the latter than we’re getting of the former.

And there’s no mystery to all of this, but if we’re able to tell these politicians to the point, where they’re almost not brave enough to go on the streets unless they’re fully armed to come up with some answers on what they’re actually doing to change it.

It all sounds really simple, I guess, but unless enough of us are equipped with this knowledge, this crippling effect of government intervention will go on.

But if there’s enough of us, the politicians might take steps to limit government activity to its correct role of referee and protector of individual’s rights and their property. That’s necessary. It’s slow, but it’s necessary, and the encouraging thing is it’s certainly happening in the U.S. And it’s certainly happening in England.

And there’s certainly no reason why it can’t happen here, because there’s enough people now being turned on about this. There’s a big economic conference in Sydney called the Mont Pelerin Society Meeting next month that is going to stimulate a lot of this stuff and I think Madsen Pirie is coming back for that.

And number two way we can change this thing around is to cease to be part of the problem and become part of the solution instead. I’ll be terribly brief on this one, because I’d a love a motion to come out of here to this effect.

Now, every major segment of Australia is gaining benefits from government expenditure. And if we, we look mainly to be businesspeople here, so I can speak to that broad term, if we as businesspeople start saying: trim the aboriginal budget, trim the unemployment, trim everything else. You know, that’s just us knocking some other bloke, that we want to be left alone.

I think we’ve got to set the pattern, and set the example, and say, hey, we’re all receiving benefits, we must be the key, and we, as businesspeople, must say look at all these subsidies we’re getting, look at all these organisations doing all this work for us: the Ex-Im Bank in Perth, the WA Development Corporation in West Australia, Small Business Development. Put them all together they’re just on a state level, multiply that again by the federal level, put them all together, and that’s hundreds of millions of dollars that we are collecting as subsidy.

We really lose so much credibility, especially with the younger people, when we stand up and talk about the free enterprise system, we really lack credibility. If we take this step, and I’d be happy to organise a resolution from tonight’s meeting, if we can come out of this meeting to fire a cannon into the Chambers of Congress and all the other federated industry organisations that we’re involved with to say, what about us taking a step? And see where we go from there. And I think once we’ve done that, then a few of us can throw down the gauntlet to the other official groups, like the farmers organizations and the labour unions, and then we can put Canberra on this long needed diet.

The third step is massive peaceful civil disobedience from the business sector. It’s one that we don’t need to be a member of anything. We can just do it ourselves and I’ve been doing it for years and I love it. It’s just such good fun and it doesn’t cost very much money either to do. And I think, on this case, with this White Paper, we should get up off of our knees and make sure that we as businesspeople say, well, they can have their consumption tax if they like, but we’re not going to collect it for them and it’ll make us, our job easier if we can get some of the big organisations on side if we can tell them the same thing.

It’s just a matter of injecting some backbone into some of these organisations who are getting to the stage of being pretty well switched on. If they exhibited some unity and they sort of started with the consumer tax and said well we won’t collect that, then we could move on and say well the government, dear government, please make your own arrangements on the group tax, the payroll tax, the sales tax and the proscribed payments tax too.

They can have all these taxes if they want, but let them do the work, as the Government. But lets not be the middleman dipping fingers into people’s pay-packets and passing it on to some other bloke as we’re doing now.

And I think, until that happens, and it’s not impossible for that to happen. But until that happens, I mean let’s see how the unions handle it. The thought was in this tax summit was that they get fringe tax benefits. The union said, they’re not going to tax us for fringe benefits. The government said, oh well, we can’t go that way, so they’re going to tax the businesspeople. The businesspeople haven’t murmured, they’re just going to remit the tax on fringe benefits, company cars, company houses. There hasn’t been a murmur and I find that appalling.

Bob you’re right, plugging into the organisations we’re talking about, make some mention there, but anyway meanwhile we can exhibit some non-compliant behaviour, just perhaps as individuals and there’s a couple of examples here, that I think it’s important never to cooperate with any of these guys, whether it’s a tax inspector or bureaucracy guy or anyone, because you can’t really logically be expected to assist a thief if he comes to your house. You really must make his job as difficult as you possibly can.

If you’re investigated and you receive one of these dreadful long departmental itemized questionnaires, delay the reply as long as you can. Then, when they run out of patience, we’ve got plenty of patience, but when they run out it, ask for a copy of their original letter as you appear to have mislaid it.

When you reply, with very exact answers, give the wrong reference numbers and file numbers. It could be that they’ll be unable to match up all this information and they’ll be too embarrassed to proceed with the matter any further. Eventually they may write asking for more detailed answers in the hope that this would give them clues to the original questions enabling them to trace the reference numbers that you quoted.

When you reply this time, quoting the correct reference numbers, you should give exact answers, but to entirely different questions, fictitious questions.

This will start the cycle over again and you can bombard them with requests for a copy of their original letter, which they never ever wrote. The challenge is to keep this sort of thing going on for as long as possible, perhaps ten years or so, as it’s good therapy for their staff. A lot of people I know, when replying to the Tax Department, stick the stamp on the top-left corner of the envelope or sometimes in the centre.

I’ve never bothered to put the stamp on any of the correspondence. They always pay the surplus, it never comes back, and they’re always going to pay and get it because they live in high hopes that there’s some money in the envelopes.

If you ever find yourself in the position of having to send them money, always send the wrong amount. And always staple your cheque in the centre of the form. It serves to jam up their electronic receipting devices.

Rub candle grease in the space marked, “For Official Use Only.” If you’re short of candle grease, use hair oil.

When you’re investigated, among the first things they do is run to your bank, and without your knowledge, this is the appalling thing, they copy all your bank records and all your cancelled cheques and all, so it may be best to have your bank cheques printed, as you can have these days, on dark red paper. It’s almost impossible to distinguish the dark red paper from the ink when they do the photocopies.

There’s also a particularly fine pen, they’re called Commercial Light Blue Illustrator Non-reproducing pen. It’s a thin pen that will not reproduce on microfilm copies or photocopies.

The object of their investigations is linked to the tax man having to generate a certain dollar volume for each hour of work. And it’s possible that if you can run up their time they may wish to avoid you entirely. With a bit of luck, they may even take you off their mailing list too.

Actually, a sure-fire way of upsetting them seems to be to, I did try this, is to include some unspecified sundry income on your tax return. Even if it’s only for a few hundred dollars. They’re paranoid. They keep insisting that you inform them where this unspecified income came from. And you just have to explain to them that you must be honest, otherwise you wouldn’t have declared it; it’s really the undeclared income that they should be worrying about.

And the other one here, is, when replying to their correspondence or in personal interviews, I think this is most important, always try to establish some good human relationship with your investigator at all times. Apart from asking about his family, and his ancestry, make the odd inquiry about what he’s doing with all this money he’s ripping off of his fellow Australians. And asking also, has he ever considered going out and getting a proper job? Keep it all nice and warm.

There’s lots of other ways of maintaining good relationships with your investigators, and introduce this relaxed element into these dealings, I think, at all times.

Greg would probably know more about this subject that I would, but whilst there is some legal grounds for tax inspectors to gain access to your records, there’s nothing to permit them to remove these records from your premises. I recall that we used to keep our receipts in a large plastic rubbish bin, which we used to stir up with a broomstick at the end of each day when the fellow had left. It was a bit of a game actually.

There’s also nothing that says you should give them cups of tea. They’re pretty soft about these things, so we used to keep up a steady supply of tea. There’s also nothing to say that you must permit them the use of your toilet. Creates the problem earlier and then of course while they’re away, back at their motel, stir the old rubbish bin up again.

There are many disadvantages, but more advantages, of being classified as a contractor. And over the years we’ve sold many of these contractors’ contract forms, to assist people in achieving that status. It helps them hold their money longer and at least earn some interest on it, and it also gives them more tax deductions. The real one big disadvantage is maybe that they could end up paying provisional tax, but that’s only a problem if they pay the tax on time.

The success of such contract forms really depends on your own particular circumstances and advice should be obtained from others on this. There are specified legal tests to define what is a contractor and what is a contract and what isn’t. And these tests, and there’s no question: you are one or you aren’t one. And this is where you should get the proper advice on this.

This does remind me of one Tax Department where they decided to question the validity of prostitutes actually using these contractors contract forms. Very delicate, very delicate situation actually with the ladies here, but, these girls were using these contract forms so that they, in fact, could break this Tax Departments automatic access to their cash.

So, the prostitute, of course, went off to court where the judge, after hearing all the evidence, agreed with the girls defence, that these prostitutes had in fact complied with the legal description of what is a contractor.

The three tests were, could they complete the task without constant supervision from their employer? It was established in court that they could.

Test two. Did they have control over the standard of workmanship? The court established that the answer was yes.

The third test was, did they bring their own tools to the job? The court again agreed that yes, they were, in fact, contractors, and the case from the Tax Department was thrown out amid some amusement.

I could go on with these examples all night but they only serve to show that being in business can be entertaining if we approach it with the right mental attitude. There’s probably one final point which covers the survival bit when we’re faced with governments with their spending diarrhoea. I see governments as like a pet monkey we took on once when it was nice and small, like a small kitten. Now, it’s grown into this raging gorilla with the diarrhoea, with this great big hole through which all the money is just falling. I think Greg and I think John Jones and I think Bob Muirhead mentioned about putting the government on a diet. This is what many people are doing by joining the underground economy, which is now being graced with more dignified names such as the unreported economy.

Instead of these people connecting business through conventional channels, they live in an alternative world where substantial discounts are given for cash. I don’t know very much about this, but I know it’s at a stage in Australia where it’s becoming very significant.

I know in some countries the unreported economy is said to represent 60% of the total Gross Domestic Product and in India, for instance, the government is unable to prepare any meaningful national accounts without acknowledging the economic contribution from the unreported economy.

Now, once again, if we are faced with a flat rate or a reasonable taxation level, the unreported economy would shrink. But when the productive sector feels under siege as it is now, it will expand, and this could be the subject of a separate talk by one of the many experts in this field.

So, on the subject of the unreported economy, as one of the things that could be done, I’ll certainly close my little part of the thing, and if I could just refer to a poem on the same subject that I WROTE some years ago when I must have had nothing to do. It’s called, “Taxation and Survival.” Here we go.

Perhaps we are all orchardists at heart.

Having prepared the soil, nurtured the vines,

patiently attending the trees, watching our fruit slowly ripen.

Evidencing that our labours were meaningful.Suddenly, from the dark clouds swoop scavengers,

to pick the eyes and decimate our fruit.To remain as bystanders would be

in neglect of our responsibility.Surely we have but two choices.

Shoot the bastards, but perhaps they would

quickly be replaced by even more.Instead, lets gather the fruit swiftly

and store it out of reach.

That way the decision still remains with us,

of how we should share the products of our labours.

[This poem can also be found in Ron Manners, “Taxation and survival,” The Bulletin, August 18, 1981, p. 17, as a letter to the editor; and on page 87 of Heroic Misadventures where it is dated 1979.]

[Ron now acts as chairman thanking someone who travelled furthest to attend the meeting. Hard to hear all of it.]

There were several examples of government waste and fraudulent misuse of taxpayers money. But I thought the best one, to cap the night off, was this money for jobless spent instead on the peace bus. Did anyone see in this in the Australian on the weekend?

There’s $170,000 from the Community Employment Program which was given to the peace movement between February and December last year, which they were spending on this bus, travelling around Australia, teaching you young people how to demonstrate. And they conduct demonstrations and block progress and be Greenies, lovely Greenie signs all over the bus.

And my comment here is that nobody has asked the Australian taxpayers if they’re happy with their investment of $174,000 in this peace project.

This seemingly fraudulent misuse of taxpayers money is a classic example of what the economists call the confidence trick of concentrated benefits to those receiving them versus diffused costs for those paying them.

That’s the sleight of hand by which they spend most of the money: the costs are spread among many of us, the benefits are among few and they get the full credit for that. This is continuing on such a grand scale that the governments current call for the introduction of yet further taxes can do nothing but swell the membership ranks of Taxpayers United. It’s only fitting, therefore, that Taxpayers United make a symbolic presentation of a one-way ticket to Canberra on our very own peace bus.

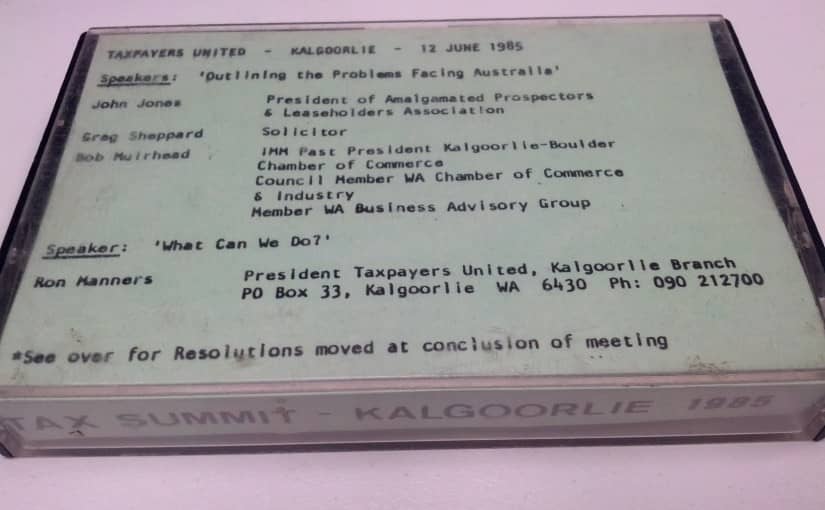

Tax Summit Resolutions, as printed on inside-cover of audio cassette insert:

- That the Federal Government be requested to withdraw their proposal to impose a tax on income resulting from the production of gold, and that they instead examine the exemptions currently applicable to such income, and the income derived from Australian film investments. These studies to be used as an economic model to be applied to other industries to stimulate the widespread creation of prosperity and employment.

- That business groups and employer federations, those who truly believe in the power of the competitive market place, start the government budget cutting ball rolling immediately by urging reductions in specific government subsidies to business. Once business gets its house in order and presses for the abolition of all state and federal business subsidising organisations, they can they throw down the gauntlet to other pressure groups such as labour unions, farm organisations, etc, and put Canberra on a long needed diet.

- Urge major employer bodies to exhibit some unity by telling governments to make their own arrangements in connection with collecting the proposed consumer tax, and the existing group tax, payroll tax and sales tax.

- To encourage peaceful non-compliant behaviour by businessmen toward the tax man and the bureaucracy.