This presentation was given at the 1999 Mining in the Goldfields – Opportunities and Challenges conference, and talked about recent mineral discoveries, the region’s potential and the many challenges faced by exploration companies. The conference was drew a number of delegates, including Resources Development and Energy Minister at the time, Colin Barnett, and focused on the future of mining, with an emphasis on relationship between mining companies and indigenous people as well as technology in mining. At the time, Hugh Gallagher, executive director of Kalgoorlie Boulder Chamber of Commerce and Industry, and Ian Satchwell, chief executive officer for the Chamber of Minerals and Energy of Western Australia, said his presentation “achieved a balance between highlighting the fantastic potential for future mineral discoveries in the region and the urgent need to address impediments”.

It started with a joke

Two engineering students were recently talking on the campus when one said: “Where did you get such a great bike?” The second engineer replied: “I was walking along yesterday minding my own business, when a beautiful girl rode up on this bike. She threw the bike to the ground, took of all her clothes and said ‘take what you want!’” The second engineer nodded approvingly. “Good choice; the clothes probably wouldn’t have fit.”

This a ‘semi’ true story, applies to today’s conference as it’s all about recognizing opportunities when you see them. Nobody trips over mountains. It is the small pebbles that cause us to stumble. If we pass all the pebbles in our path we will find that we have crossed the mountain of our immediate concerns.

Yes, Kalgoorlie has a few problems right now, as we will discuss, but nothing can take away the mineral potential of the region that has the ability to give us an even bigger and brighter second century; for those prepared to buy a ticket and sign on for the adventure.

Here is what we are going to cover in the next few minutes:

- Prospectivity of the Goldfields, recent discoveries and future potential

2. Challenges facing exploration and mining (gold price, access to capital, access to land, poor public perception)

3. I know the program actually says that we will be ‘addressing’ these challenges, but I hate the word ‘addressing’ as it is a political weasel-word that purposefully avoids action, so instead we will suggest some helpful action that our mining industry can take, and also some helpful action that our Goldfields community can take.

We are dealing with a world class mining region based on Kalgoorlie.

Prospectivity of the Kalgoorlie Goldfields

- Over a century of continuous gold mining and discovery history

- Production in excess of $55m ounces of gold

- Extensive greenstone belt sequences under shallow cover

- Excellent infrastructure and site access

- Extensive modern geological and geophysical data-sets in the public domain

- Project capex requirements are low by industry standards

- Semi-arid climate allows easier exploration and lower development and capex costs

- Zero natural disaster history

- Dynamic tenure position with over 100 companies exploring in the region

- Fast project lead times

- Gold ores are typically free milling

- Strong mining culture

- Highly educated workforce

- Extensive service base from Kalgoorlie

- Numerous multi-million ounce mine camps Kalgoorlie, Coolgardie, Kambalda, Norseman, Laverton, Yandal Belt, Wiluna

- Recent discoveries–Centenary, Wallaby, Aphrodite, Kundana East and Ghost Crab confirm region’s potential

- Cost of discovery per resource ounce is among the lowest in the world at around $20 per ounce (average recently reduced by Yandal Belt and Wallaby discoveries).

- Even when expressed in total exploration dollars per ounce of production, the figure is an impressive $59.

Recent discoveries indicates future potential gold

Wallaby 42m tonnes @ 2.8g/t 3.8Moz

White Foil 12m tonnes @ 2.4g/t 0.9Moz

Ghost Crab 4m tonnes @ 5.0g/t 0.6Moz

Kundana East 2m tonnes @ 5.2g/t 0.35Moz

Carosue Dam 16.5m tonnes @ 1.96g/t 1.0Moz

Red October 0.6m tonnes @ 0.12g/t 0.12Moz

Golden Cities 7.2m tonnes @ 2.2g/t 0.5Moz

Aphrodite 2.6m tonnes @ 6.0g/t 0.5Moz

TOTAL 7.77Moz

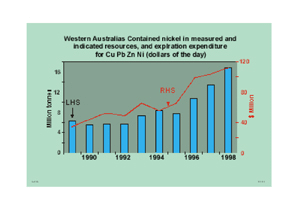

Nickel in WA

Murrin Murrin (Anaconda): 500 employees running Stage 1 which cost $1.03 billion. Stage 1 will earn $500 million pa in exports. During Stage 1 construction phase more than 8,000 people worked on the project. 213mt ore @0 .70% Ni resource. Stage 2 will lift production by 150% to 100,000 tonnes of nickel and 8,500 tonnes cobalt and will cost a further $1 billion. On completion of Stage 2, Murrin Murrin is forecast to be the worlds lowest cost producer of nickel.

Cawse Nickel (Centaur): 210 employees operate the Bulong site. $240 million spent so far on capex at Bulong. Production aimed at 4,000t Ni and 400t cobalt with mine life 50 years. 40mt ore @ 1.14%

Bulong (Preston): 240 employees, forecast production of 9,600t Ni and 1,000t Co pa. $300 million capex 30 year mine life.

Ravensthorpe (Comet): 152mt @ 0.8% Ni resource, feed grade via screening est. to be 2% Ni, Multiplex agreement to source financing, Capex est at A$720 million, plant to produce 25,000t pa Ni and 1,900tpa Co.

Kalpini (Heron): Heron Resources Kalpini resource 85MT @ 1.07% Ni, development model by Bateman Kinhill underway with project capex est of $880 million. Joint Venture with Centaur has just been announced.

Silver Swan/Cygnet (Outokumpu Oy): Recent announcement of $13 million go ahead to mine the Cygnet ore zone – 744,000 t @ 2.4 %c Ni sulphide deposit, close to the rich Silver Swan Ni ore. The mine currently produces 13,000tpa Ni and this will grow to 18,000tpa Ni via concentrate to Finland smelter. The Black Swan plant will be upgraded by relocating the Forrestania nickel plant. Current employees 100 will increase to 130 plus extra 40 during plant upgrade.

Cosmos (Jubilee): High grade Ni sulphide deposit south of Mt Keith. Development options are currently being considered with capex estimated at $38 million. The financing facility just announced has enabled Jubilee Gold Mines to activate this project.

Mt Keith (WMC): 269mt @ .58% Ni process 12 mtpa produce 40,000tpa Ni

450 employees Revenue ~ $400 million pa

Kalgoorlie Nickel Smelter (WMC)

400 people Kambalda Ni 250 people Leinster 721 people

State Government Nickel Royalty receipts in 1998 were $27 Million from production of 150,000 tonnes of Ni in WA.

Current Gold Industry Status From Norseman to Wiluna

In 1999/2000 this Kalgoorlie region will:

- Treat over 60m tonnes of ore

- Produce 6.3m ounces (196 tonnes) of gold

- Pay state royalties of $21m

- Generate gold export revenue of $3.6b

- Provide 10,400 jobs directly and a further 40,000 flow on jobs

- In1998/99$616millionwasspentonexplorationinWA.Sixtyfivepercentofthisfigurewasspentongold exploration = $400 million. It is estimated that the Kalgoorlie region will commit a minimum $200 million in exploration funds for gold and nickel in 1999/2000

- Significantmineclosuresoverthepastfewyearshavebeencompensatedbynewdiscoveriesandproduction upgrades to existing mines, Wallaby for example will produce more than 500,000 ounces per annum (with a far longer average lifespan than those closed) having an annual production rate greater than the following recent mine closures:

Mt Mclure 85,000oz, Kaltails 65,000, Ora Banda 70,000, Bannockburn 70,000, Daveyhurst 70,000, Mt Morgans 75,000, Three Mile Hill 65,000. Total 500,000oz

Looking back for a moment

Having established the tremendous potential that lies ahead, we know the race is worth running, but let us look back before we consider the challenges or hurdles. This momentary pause that Kalgoorlie is experiencing in 1999 is not a new experience to this region and when I opened a few files at the weekend, I found that I had shared several of Kalgoorlie’s low spots before.

The first for me was in 1962 after the Federal Government’s credit squeeze resulted in the cutting off of all credit facilities outside the capital cities. This credit squeeze was caused by the Federal Government forcing the trading banks to deposit money with the Reserve Bank at half a per cent interest, thus taking money out of circulation. This resulted in what I called Kalgoorlie’s ‘Grim ‘60s’ and in a talk I gave at the time I mentioned a statistic that one house in every seven-and-a-half was on the market. Business was so quiet for me that I went farming at Esperance for three days per week.

We formed a local branch of the Jaycees, and ran a range of seminars to keep our own spirits up and managed to get a few projects off the ground such as the Museum of the Goldfields. We also generated a great nucleus of enthusiasts who were well prepared for the ‘Kalgoorlie Industrial Revolution’ that followed Western Mining’s discovery of nickel at Kambalda in 1966, this of course was followed by the sensational Poseidon nickel boom.

Remember this: only those who were prepared, benefited.

An interesting 1973 booklet I unearthed last weekend was titled Kalgoorlie – A Case for a Regional Centre, this was an early strategy for the service centre concept.

The next crisis in confidence was in 1977 when the nickel boom had completely deserted us and we were running out of gold mines. The Kalgoorlie Chamber of Commerce took the lead and arranged a seminar similar to todays. A great bunch of speakers from all over. Inevitably, as president of the Chamber of Commerce, I gave a speech titled, Kalgoorlie Looking Good – Feeling Awful. I glanced through the speech last weekend and there were some hilarious similarities between then and now.

The range of challenges were similar but not identical. One heading, was ‘How Much Regulation is Too Much?’ and there was even a suggestion that we should put the regulators and anti-mining lobbyists on the defense. Of significance the paper identified the regulatory stranglehold on our transport industry at the time and the Chamber went to work to systematically have all restrictive regulation repealed. We accepted the challenge that repealing laws required a greater skill that simply breaking them.

Just to give you an idea on how transport contributed to our costs. In 1977 it was illegal for any of you to transport your own furniture from Perth to Kalgoorlie, even if you had just bought a cupboard and brought it back home in your Holden ute. The crime was that you were competing with the monopoly railways.

Similarly it was illegal for any airline to sell tickets for flights from Melbourne or Adelaide to Kalgoorlie. Monopolies were in place and it suited them to have eastern states travellers fly overhead to Perth, and then take another flight back to Kalgoorlie the next day.

The Kalgoorlie Chamber of Commerce, with assistance from Professor Martyn Webb and the WA Chamber, were instrumental in overpowering the bureaucracy with submissions and our Chamber has since been credited with leading the charge on these transport issues. I only mention this as proof that people of goodwill can transfer thoughts into action and although the issues may be different, the results can again be successful.

Looking through those notes, it is hard to believe how grim things were in 1977, however that seminar was the catalyst for activating Kalgoorlie as the ‘regional service centre’, where Kalgoorlie is now unique throughout the world as a mining service centre (You may not be aware of this but there are no Kalgoorlie equivalents in South Africa, South America, USA or Europe).

That seminar was the catalyst for the east-west, north-south transport hub concept and the provision of services from local providers to the rest of the state and in particular the iron ore mines in the Pilbara. Out of all that, stimulated over subsequent years, by a series of enthusiastic Chamber presidents, they have developed many initiatives not the least being the Goldfields Mining Expo which displayed our ability to host large functions. Little did we know, at that 1977 conference that the gold price would rocket to US$834 just two-and-a-half years later and again, only those who were ready would benefit.

The next time we had a similar seminar was in October 1990, called ‘Kalgoorlie – The Next 100 Years’, an AMEC (Association of Mining and Exploration Companies) sponsored event in conjunction with the Kalgoorlie Chamber of Commerce, at which we had another Ron-talk called Barnacles (on the Backside of Progress). There were some danger signals in the downturn in exploration, and we were losing many exploration companies and exploration budgets to offshore locations. By the end of 1992, we saw one of Australia’s largest exploration companies spending only 10 per cent of its budget within Australia, the rest overseas.

As a result of government policies in the ‘80s, we saw Australian mining companies increase investment overseas from $4.2b in 1980 to $32.3b in 1989 – a nine-time increased in nine years.

There were a few problems at that time that needed attention, and as I explained:

“The mining industry is traditionally very shy and reluctant to adopt a high profile. We stick to mining and exploration and under normal circumstances that’s the way it should be, however there is such a downturn in local exploration that we can’t remain silent much longer.

“To explain my concern let’s think of exploration as being a bit like football. Exploration is about kicking goals. Each time we have a new discovery, it’s like kicking a goal for Kalgoorlie, in that it means there’s a new mine out there in front, that will be developed in the next few years, resulting in more employment opportunities and more excitement, and in turn more exploration.”

We then managed to identify a few ‘barnacles’ that were holding us back and ‘fleas’ that were annoying us, which we subsequently brushed off and tightened up our operations just in time to enjoy some superb growth years in the mid ‘90s, in fact some of Kalgoorlie’s best growth years. But they were only enjoyed by those who trimmed their sails to match the wind and who got ready for the opportunities.

We see this pattern continually repeating itself and it was perfectly described by Sir Arvi Parbo a couple of weeks ago whilst he was in Kalgoorlie:

“One of the important lessons from the past is that the downturns are a time for opportunities for those who are able and willing to grasp them. Rewards are great for those who can use the downturns to position themselves to benefit, when the inevitable upturn comes.”

Well that’s the end of the reminiscing, so here we are in 1999 preparing ourselves for the next ride of our lifetime and the only people I feel sorry for are the ones without a ticket to ride.

On the left are view of Kalgoorlie’s cycles. Each one leaves previous cycles for dead. They each take off from a higher base and develop a life of their own, so get ready for the next one.

On the left are view of Kalgoorlie’s cycles. Each one leaves previous cycles for dead. They each take off from a higher base and develop a life of their own, so get ready for the next one.

Where are the big deposits yet to be found around Kalgoorlie?

From examining the recent discoveries of Wallaby, Sunrise and others they have all been found in known belts, often very close to existing operations. All have been found under cover of sand dunes or salt lakes or thick overburden. All have been targeted using a very strong emphasis on geophysics, geological modelling and backing up these theories with deeper drilling.

All, once discovered, have been very rapidly and economically delineated. All recently discovered deposits have been found in areas historically identified as being highly prospective for gold. We have found the carpark, we just need to find our car! We know where to look – we have to look smarter. This tells us that the place to look is where we looked before but to use new thinking and new tools. If this is the gold that we have found in the top 100 metres, then where, along that trend, will it continue at depth into a sulphide system and how do I target that for drilling and what tools do I use?

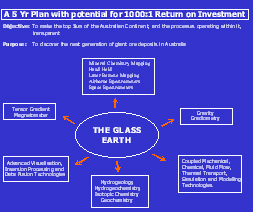

As we used soil sampling and RAB drilling to delineate early oxide deposits, we now have to group all that information into one data-set and use that as the geochemical indicator for sulphide deposits below. The mining industry is receiving useful input in the quest to ‘see through’ our earth’s crust and CSIRO’s exploration and mining chief, Dr Bruce Hobbs, is coordinating a suite of powerful new technology to penetrate the first kilometre in depth. He calls this project The Glass Earth because the intent is to make the landmass transparent from the point of view of mineral exploration.

The Glass Earth concept plans to discover the next generation of giant ore deposits in Australia by making the top 1km of the Australian continent, and the processes operating within it, transparent.

Now with all this revolutionary stuff happening, right now, in 1999, should be an excellent time to accelerate our exploration efforts, to in effect turbocharge our exploration programs because of the current availability of technical people and facilities. Drilling costs over the last ten years, expressed in constant dollars have remained the same so in depreciated dollars represents about half-price. In addition, technical advancements to drilling have resulted in doubling penetration rates so in effect we have four-times the productivity from just this one branch of the industry.

I will concentrate on drilling because as many of you know, it all starts with the drilling.

Now let me demonstrate the immediate benefits that will flow to Kalgoorlie if we could turn the current unworkable Native Title Act into a workable document. For this exercise I will use as an example a modest sized gold mining company which I understand is Kalgoorlie’s only listed gold producer with its registered office and management based in Kalgoorlie.

Yes, it’s called Croesus Mining and I am even prouder than ever to be the chairman since they have just completed the company ’s most successful year in both production and profit. Unfortunately lack of exploration access to many of our tenements, has forced us to accumulate profits to a point where we now have $22m in cash. Our desperate desire is to expand our exploration program to cover eight excellent projects on which exciting drill targets have been identified. We would be busily drilling them now if it were not for Native Title claims frustrating the approvals process.

The targets identified already would require 80,000m of drilling at a cost of $2m, which represents one drill rig continuously drilling for a year. Now I know that we are only a relatively small company, but it is easy to extrapolate this out and to apply a similar situation to another 50 local operating mining companies, so there you have 50 companies at $2m per annum representing an additional $100m expenditure per annum which would fully occupy 50 RAB or Aircore drill rigs for a whole year.

Imagine the flow on result to Kalgoorlie from the additional assay work and subsequent services. And we all know that this additional drilling would reveal further targets and we would have that wonderful compounding effect, turbocharging us into the future. This is what should be happening, but instead we are in here talking, instead of being out there doing.

The Challenges Facing Exploration and Mining and Kalgoorlie

In this brief look at what is slowing our region down, the good news is that we don’t have many problems, very few in fact when compared with many other countries. The bad news however is that some of the problems are malignant and need urgent surgery before we can move forward again.

The only three problems that I can see stopping us from flying are:

- The unworkable Native Title Act

- Investor sentiment

- The enemies of our industry and the poor public attitude to our industry.

I will hit each of these quickly so we don’t have time to get too negative. The Native Title Act as most you know is all right except that it doesn’t work.

This graph (left) shows mining title applications and approvals. If you require evidence that it doesn’t work just look at the chart, which shows the backlog of mining tenements, where we now have an accumulated total of 11,000 tenements held up because of Native Title claims.

The High Court originally created a problem by suggesting that their judgement from somewhere else (the Island of Mer), could be imported to mainland Australia (where an entirely different set of circumstances existed), so just as Britain had an outbreak of Mad Cow Disease, Australia’s economy was damaged by an outbreak of Mad Judge Disease. The resulting damage to our economy has been calculated to be more than $30 billion.

Prime Minister Paul Keating then came along and passed the Native Title Act, just in time to rescue the High Court from exposure for their folly. Now, we didn’t mind Paul Keating trying to offload the entire responsibility for the welfare of our Aboriginal people onto the mining industry, but we felt that the real Aboriginal people (not their advisors) would benefit more from keeping our mining industry in Australia, so there has been a five year stand -off while people of goodwill on both sides of the argument have been trying to make this abomination workable.

We congratulate our state government for their early recognition of the economic damage and for drafting reasonable state legislation. I am sure they would be moving forward by now if it wasn’t for two or three politicians that history will judge, by suggesting that they have sucked their brains right up their backsides. Yes, I mean that. We have tried being polite and taking them to lunch, but when asked why they don’t vote for the state legislation, they just mutter something about not wanting to “betray the Paul Keating vision”.

Well, they have to make a decision between the Paul Keating vision and the very people that elected them. That is a decision for them, but you as voters can put the pressure on them. The solution lies in exerting all the pressure we can bring to bear, as a community, to convince those three reluctant politicians that, in the best interest of all Australians, they bring their brains out from hiding, and quickly pass the state legislation. If we don’t, the problem will persist, and exploration will grind to a halt, as you can see in this illustration.

Having said that, I must say that our company Croesus Mining has enjoyed excellent relationships with the Aboriginal people with whom we have worked over the past 13 years, and with whom I have personally worked for a lot longer than that, but that doesn’t alter the fact that the Native Title Act as it stands is unworkable, because it doesn’t define Native Title and it does not differentiate between claimants and holders.

Investor sentiment comes in two parts, namely the low gold price, over which we have little control, and the current poor returns to investors, over which we have considerable control. The gold price is an interesting philosophical debate and one of my favorite philosophers on the subject is Melbourne stockbroker Hugh Wallace-Smith, who this week summarized the current situation in these words;

“Demand for gold is 4,200 tonnes and rising, mine supply is 2,500 and falling, the private sector owns 90,000 tonnes of gold and is rising, the central banks own 30,000 tonnes and falling. Remember all the gold ever mined fits into an Olympic swimming pool. Hedge funds are significantly short. The bounce in gold prices is a matter of when rather than whether and I think the when is now.”

The other matter of ‘poor returns to investors’ is highlighted in recent anecdotal evidence that governments (federal, state and local) are extracting over $2b from the mining industry, which is one of the reasons why there is only $800m being distributed to shareholders.

Not only unfair, but shareholders are revolting by deserting the resource sector, and will only return when government greed is brought under control and resource company management, on a wider front than at present, elevates in priority the interests of investors. Unfortunately, we all appear to have surrendered to the dubious concept that ‘tax is taken out first’, but because the total tax we pay is so well disguised, it is not attracting the degree of revulsion that it deserves. The overall tax-take on all Australians is too high, highlighted in this article:

“Australia is being crippled by high taxes, with the average household handing over almost half its weekly cash income to the taxman, a new report shows.

“At the same time households that earn the most money each week are being taxed as high as 51 per cent…a report by the National Centre for Social and Economic Modelling states…

“It is probably not widely appreciated by the average household that their indirect and company tax payments far exceed the income tax they pay.”

‘Taxman’s Take Now Over 50 per cent’, The Sunday Telegraph. July 25, 1999)

Unfortunately the GST is not the solution to this problem as the federal government’s proposal to us that “tax revenue should remain neutral” is inconsistent with the generally accepted business practice that we must, and are able to achieve more with less. This is not unreasonable given the new technologies available to all of us including government. All governments (federal, state and local) must come under intense pressure from all of us to flatten their own management structures and meet new performance indicators. Nothing will happen unless we show signs of discontent with the ever-escalating tax take.

On a local government level in our own city, we are yet to see the benefits that we were told would flow from the council merger of ten years ago [February 1, 1989]. Incidentally, one of the parochial peculiarities of that merger was an agreement to call the city ‘Kalgoorlie-hyphen-Boulder’. For how much longer are we going to amuse visitors with such an unwieldy name for our city? There is only one dot on the map and it’s called Kalgoorlie. It may incorporate Boulder, Williamstown, Mullingar, Sommerville and other suburbs, but please, let us move on with a single name for a single city.

Enemies of Industry

We mustn’t underestimate the damage that enemies of any industry can do. I remember being told this story by Fabian Dattner, whose family once operated Australia’s largest fur coat manufacturing company. When the anti-fur brigade started their campaign to make it unfashionable to wear fur coats, the Dattner organization felt that women could never be parted from their furs, so they largely ignored the campaign. Subsequently the Dattner group went out of business when their market completed dried up.

This story came back to me when I was looking at the latest anti-mining website called GoldBusters Campaign. This well funded international anti-gold mining group on its home page promotes the following nonsense:

“The mining of gold is one of the most environmentally destructive industrial activities presently blighting our planet and wreaks havoc on indigenous communities on every continent. In dozens of countries mercury-laced tailings, eroded land and acid mine drainage stand as visible and toxic legacies of gold rushes from days gone by.

“Heroic and historic struggles are being waged from Australia to Zimbabwe by scores, if not hundreds, of groups opposing a gold mine in their own country or region. We are sending this letter out to all of you in the belief that, working in concert, we have a chance to get to the heart of the problem, instead of working separately on one poisonous symptom after another. We propose to network our groups together and build a movement against unecological gold mining.”

“GoldBusters is a two-pronged campaign aimed at jewellery consumers on the one hand, and nations gold reserves on the other. GoldBusters aims to depress the price of gold by asking governments and individuals to divest of gold investments and consumers to no longer purchase gold jewellery. Depressing the price of gold would lead to the decommissioning of many mines, and the dumping of exploration stocks by investors.

“The good news is that the price of gold has been hovering at an historic low, having dropped from $800 per ounce in 1979 to under $300 at present. This reduces the demand for new gold mines and so the current depression in the price of gold is good for the planet. For example, twenty gold mines in Australia have been postponed or closed since the value of gold fell below $300 per ounce.

“Our job is made easier by the trivial uses to which most gold is put. Some 80 per cent of new gold being mined worldwide is for jewellery. In the US, 70 per cent of the gold jewellery purchased is bought by women who certainly are unaware of the true costs of the gold they wear. Women and men are being asked to lay down their gold jewels as they give voice to their care for the earth, and for future generations.”

Now all this may be nonsense, but we shouldn’t underestimate the damage that this high-powered, well-financed campaign can do and we must learn to fight back. What can we do?

Find out if you, as a taxpayer, are contributing to this campaign, which from our Australian end is closely related to the Rainforest Information Centre and the Timbarra Action Coalition. If it is your money being used against you in this fashion, you have every right to demand an explanation from your federal member.

While I defend anyone’s right to express their opinions (as long as it is at their own expense), the fact that this nonsense can be propagated without any outcry from our own industry or Australians generally, indicates to me that we have done a poor job of projecting our industry’s image. It also indicates that these people haven’t visited any mines recently.

You as individuals, either directly involved in the industry, or directly involved in support and facilitation such as the service and governmental approvals, all have so much to be proud of, but we appear to have invested so little in explaining this to the wider community. Every Australian should be reminded that our very civilization, that we take for granted, rests on the basis of mining. Every time we raise a glass, or a can, or a stubby (all products of mining) to our lips to drink a toast to anyone, we should add “and to mining”.

Every time we clean our teeth we should recognize our toothbrush and toothpaste as products of mining and the petroleum branch of the mining industry. Every time the ladies make themselves look even more beautiful, with cosmetics (products of mining), they should give thanks to our industry. Every time we sit on that toilet seat (a product of mining) we should similarly give thanks. Every time, we or the ‘greenie extremies’ or other enemies of our industry turn on a light switch, step into their car or turn on their microwave oven or TV set, they should give a silent prayer to the mining industry.

They can reserve the right to be ‘greenie extremies’ or enemies of industry, but to be consistent they should enjoy freezing in the dark. And for us to be consistent, if we wish to enjoy the benefits that our industry delivers to civilization, we must pay the price of supporting our industry with concrete, visible projects such as the Australian Prospectors and Miners Hall of Fame.

What Else Can We Do?

We have already covered many of the points from our to do list and I will throw in a few more. Mining companies must:

Innovate. The world has changed and if we don’t change with it we’ll disappear. Every major industry in Australia was once a growth industry. The reason growth stops, is always because there has been a failure in executive leadership within the organization itself. Leadership demands innovation, which historically has repeatedly lifted Kalgoorlie out of its previous ‘pauses’. The style of leadership that the industry needs to develop is one that remembers that leadership is not about popularity. Things have to be done and things have to be said. Those of you who saw the movie Braveheart may remember how Wallace, the Scottish leader was described:

“Wallace was a man of action, and he made men of politics uncomfortable”.

On the subject of innovation, a student at Australian National University is currently compiling her thesis on Innovation in the Mining Industry. Sarah Vandermark thinks that we are helping her with her paper, but I know that she is helping our industry by writing it. It could be a best seller.

Sack with skill. There is a wonderful new book, The Living Company, by a former Shell company planner Arie de Geus. He talks about tolerant pruning of roses versus rigid pruning. He says that if you prune your roses rigidly, you may well get the biggest roses this year. But if you prune them tolerantly, you will get good roses every year. I think that is an excellent analogy and could save Kalgoorlie from the unwelcome ‘earthquakes’ of mass sackings when large companies leave their pruning too late in the season.

Pay bills on time. No damage is more devastating than companies, in tough times, to think it’s smart to delay payment for services or goods received. The devastating effect of this causes untold damage to those in our community who are least able to bear the pain.

Support vigorously the AMEC sponsored tax proposal that has been presented to Canberra. This proposal suggests the use of ‘flow through’ shares as a mineral exploration incentive. This concept works successfully in Canada where companies are able to transfer to shareholders the tax deductions associated with bona fide exploration work by way of issuing flow through shares. The tax deduction resulting from certain exploration expenditure incurred by the company (with specified limitations) is then passed on to the shareholder and is subsequently not deductible to the company. The purpose is to attract new investors to mineral exploration, which is to the benefit of every single Australian.

Companies should enthusiastically support their industry organizations. Such as the Chamber of Minerals and Energy in each state, the Minerals Council of Australia and AMEC, and the recently formed Australian Gold Council. These organizations are effective spokesmen for our industry, to augment the action that every single company should be taking themselves. Particular comment should be made of the Australian Gold Council’s sharp focus and the effective way they are working with the other industry organizations. At the foot of every document that leaves the Australian Gold Council is this brief message that highlights the importance of Australia’s gold industry:

“Australian Gold: rich in history, rich in potential, exports $7 billion. Production 10 million ounces. Exploration $550 million. 100 gold mines. 270 producers and explorers.”

In addition to the above, we are also counting on a large degree of corporate support for our Australian Prospectors and Miners Hall of Fame, which will be another very effective tool in the promotion of our industry.

Action for the government and the community

I link the government and the community together because we must remember that government is the servant of the people and should only be obeying our instructions. Over the past few decades it has been fashionable for governments to load up our resource industries with all manner of taxes, royalties, levies, environmental bonds and license fees to the point where explorers and miners are saying “we can do better for our shareholders by going overseas”.

Our governments must rethink their whole attitude to exploration and mining in Australia. If they want more of it, they have to learn to encourage it and if they want less mining, less exports and reduced employment opportunities then present tax policies will achieve that. Government policies will only change, with pressure from the electorate. On the local government issue I can only suggest the formation of a welcoming committee to target and attract exploration companies back to Kalgoorlie, to compensate for those we have lost recently. Naturally our council should be actively encouraging all kinds of development to the area.

On a more individualistic note I would suggest that any local entrepreneur wishing to participate in the next exciting chapter of Kalgoorlie’s history should be out there buying control of one of the crippled listed exploration companies and grub-staking a geologist into partnering him in rebuilding that company as an opportunity vehicle to be ready for the next market upswing. If you wait for the next upswing and then embark on a twelve-month corporate restructuring, you will miss the bus.

And lastly I would again commend to you, your very enthusiastic support for the Australian Prospectors and Miners Hall of Fame project. A small group of local volunteers have developed this idea so effectively that their enthusiasm has infected the Prime Minister, the Premier and a large body of Australians who are stepping forward to ensure the success of this $21m project. Its benefits to the city will be immense and when we announce our official fund raising campaign next month we look forward to your support.

Conclusion

There is a law in economics called Stein’s Law, after the economist Herb Stein. It simply states that all trends that aren’t permanent, must eventually stop. That is what’s happened to our Kalgoorlie growth, just for the moment, but today we have outlined the valid reasons why our industry and our city should rejoin the growth mode, once we deal with a few impediments that need to be surgically removed.

We all have a lot at stake as we have invested much in ourselves and our companies. The growth trend can recommence if we, as leaders of this community can overcome the very few problems and move on to the huge opportunities that will then be released.

Henry David Thoreau, the philosopher, leaves us with this thought:

“If you have built castles in the air, your work need not be lost; that is where the castles should be. Now put the foundations under them”.